Know the costs before you buy to let

According to the US National Association of Realtors (NAR), investment and holiday-home purchasing accounted for 24% of all home sales last year, as buyers sought to make the most of low interest rates and a surplus of discounted repossessed properties that could quickly be turned into rental units.

According to the US National Association of Realtors (NAR), investment and holiday-home purchasing accounted for 24% of all home sales last year, as buyers sought to make the most of low interest rates and a surplus of discounted repossessed properties that could quickly be turned into rental units.

In SA, buyers have been more cautious, despite extremely low rates, and according to the First National Bank (FNB) Property Barometer, investment or buy-to-let purchasing currently accounts for less than 10% of total purchases.

However, the trend does appear to be picking up, and those who are new to this type of investment do need to be sure that they are familiar with all the costs involved.

The main ones, as identified by the NAR, are the following:

- Bond repayments: investment properties are considered riskier, because the home is not your primary residence, so be prepared to put down a bigger deposit and possibly also for a higher rate of interest on any home loans needed to finance such properties.

- Rates and taxes: these can add significantly to the property cost, so you should contact the local municipality yourself to find out what they are before you buy.

- Levies: these will be payable to the body corporate in a sectional title development, and the home owners’ association in an estate, and again you need to establish what they are before you buy an investment property. At the same time, you need to check whether rentals are allowed in the development you intend buying into.

- Home insurance: this is the cover you will need in case the property is damaged or destroyed by fire, flood, or other disaster, and it is essential because it means that you won’t end up having to make bond repayments on a property that no longer exists, or having to pay to repair it if it is damaged. If you are buying into a sectional title complex, you need to check that this type of insurance for the whole complex is adequate and paid up to date, and also whether your portion of it is covered by your levy.

- Maintenance: you should budget 10 to 15% of the annual rent for regular maintenance and upkeep of the property, in addition to any tenant-caused damage that should be covered by the security deposit.

- Finding good tenants: it is really worth hiring a good managing agent who can check out and control tenants for you, but there is of course a fee involved and you need to budget for this as well.

- Vacancy allowance: for safety’s sake, you should assume that your property will not be rented 12 months of the year, and budget for two months of vacancy when setting your rent. If you are buying into a very high demand area, you may be able to lower this to one month.

If you’ve tallied up all these expenses and found you would still be in the black each month, a rental property might be a great investment. But you will still need to stay on top of rent collections to ensure your property pays off.

How to help your buyers understand home financing

Most prospective homebuyers are either too optimistic or too pessimistic about their chances of being granted a loan – and the reason is usually not a lack of realism about their own financial affairs, but a lack of knowledge about the banks’ current credit criteria, and about the bond application process itself.

Fortunately, though, this situation can easily be remedied if estate agents encourage buyers to seek advice from a reputable mortgage originator before they either give up on homeownership, or make an offer on a property they don’t actually qualify to buy.

False optimism, for example, might stem from a homebuyer’s belief that he or she will be able to secure a 90% or even 100% home loan – that is, that only a low deposit will be required because he or she has other assets to secure the loan.

However, this is not how banks work these days: they only look at the potential borrower’s credit history, and the disposable income left every month after living expenses have been paid and other debt obligations met. Consequently, even those with substantial assets may find that they qualify for a considerably smaller loan than they thought, or will have to save a bigger deposit, in order to bring the monthly bond repayment down to within the limits of their assessed affordability, and a good originator can provide guidance along these lines.

On the other hand, those who would like to buy a new home may be overly pessimistic about their chances of being granted a home loan because of previous credit problems, or because they believe they don’t have a big enough deposit.

And here again, a good mortgage originator will be able to provide advice with regards to any debt repair that may be necessary before potential borrowers can apply for a home loan, what type of property they could qualify to buy with the deposit they have in hand, and even whether they are eligible for any of the special home loan programmes that some banks offer first-time buyers.

Meanwhile, homebuyers also need to understand that the loan criteria of the various banks are often quite different from one another, and can also change quite frequently, as can their deposit requirements, and the interest rates they charge on home loans.

It would be extremely difficult, if not impossible, for individual consumers to keep up with all these changes, but that is exactly what mortgage originators do, and they are therefore in a position to provide a comparison of the various borrowing options on offer from at any particular time – and of course to motivate your buyer’s application to the most suitable lenders.

Banking changes improve access to homeownership

Even though prices are rising, the prospect of homeownership has been brought closer for many more South Africans over the past few months, thanks to some exciting shifts in bank lending practices.

Even though prices are rising, the prospect of homeownership has been brought closer for many more South Africans over the past few months, thanks to some exciting shifts in bank lending practices.

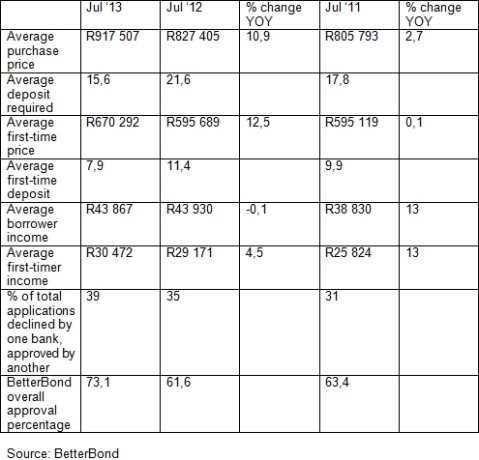

These include declining deposit requirements and increases in both the number and size of home loans being approved, and their effects are revealed in the latest statistics from BetterBond, SA’s biggest mortgage origination group.

These figures show that the average percentage of home purchase price required as a deposit when lenders are considering home loan applications, has dropped from a two-year high of 23,3% reached in February this year, to 16% currently. In addition, notes group chairman Rudi Botha, the average approved bond amount is now 8,2% up year-on-year, and at its highest level since July 2011.

“These two factors, combined with the low interest rates we continue to enjoy, are more than compensating at the moment for higher property prices, and are thus also bringing homeownership within reach again for many South African families.”

This is clearly reflected, he says, in the fact that the average household income required to purchase the average home is the same now (R44 000 a month) as it was 12 months ago, even though the average home price has increased 10,9% in that time to R918 000.

The BetterBond group statistics, which cover a quarter of all residential mortgage bonds being registered in the Deeds Office, and include applications to, and bond grants from, all the major lending banks in SA, also show that applications from first-time buyers are on the increase again, following a slump in the nine months to end-March.

“First-time buyers accounted for 39% of all bond applications in July,” says Botha, “which is still some way off the 45% mark reached a year ago, but is a considerable improvement on the 35% low recorded in March. And here too, the big motivator has been the banks’ decision to slash deposit requirements from an average 14,6% of home purchase price in March, to just 7,9% currently.”

During the same period, the average approved bond size for first-time buyers has risen by 8,9%, while the average home purchase price for first-time buyers has risen by 12,5%. For those purchasing for the first time, the effect of this is that the average household income required to purchase the average home, has risen by just 4,5% in the past 12 months. (See table)

Botha cautions however, that while the banks may be on a drive now to increase secured lending such as home loans, which are a lot less risky for them than unsecured personal loans, overdrafts, and credit card balances, their credit granting criteria are still very strict. Potential borrowers are thus well-advised to apply through a mortgage originator such as BetterBond, which will employ a multiple-submission process to different lenders, in order to give them the best chance of success.

“BetterBond is currently able to get approval for three out of every four applications it submits, but our statistics show that 56% of applications only succeed on the second or third submission,” he says.

Profit from a proximity to public transport

For those on the lookout for savvy property investment opportunities, an important new report from global property company Knight Frank gives a clear indication of the growing desirability – and swiftly rising value – of homes close to public transport hubs.

The report examines the impact that the Crossrail infrastructure project in London has already had, and is expected to have, on surrounding residential markets. And it shows that the average value of residential property within a 10 minute walk of the new Crossrail stations has risen by more than 30% since 2008 – even though the project is only schedule to go into full operation by 2018.

This, says Knight Frank, puts property value growth in the Crossrail “walk zones” at least 8% ahead of the average growth in other parts of London. What is more, a further 40% average value growth is predicted for walk zone properties by 2018.

Housing in Farringdon and Tottenham Court Road, the report predicts, will see the largest uplift – “values here are expected to rise by an additional 1,5% per year over and above the growth expected in prime central London prices, to give a total increase of 43% in the next five years”.

And in South Africa, a similar pattern is emerging now, thanks to consumers’ increasing disenchantment with traffic congestion, commuting times, and the steeply rising cost of fuel and private transport.

For example, proximity to a Gautrain station has already boosted property values – and property development – in certain parts of Johannesburg, Pretoria, Centurion, Midrand, and Kempton Park.

Lightstone figures show that in Rosebank, Johannesburg, the average price of apartments and other sectional title properties has risen from R771 000 in 2010 (prior to the Gautrain station in the area being opened) to R1,1 million currently – a 42% increase that obviously far exceeds the average property growth achieved in the city during that period.

In Hatfield, Pretoria, new developments have mushroomed to meet huge demand since the Gautrain terminus opened there in 2010, and some 455 units have been sold in the past three years. Similarly, in Halfway Gardens near the Gautrain station in Midrand, there have been 470 sectional title units sold in the past three years, and in central Kempton Park, there have been 460 sectional title units sold.

In the Western Cape, the new MyCiti rapid bus transport network is having a similar effect on property values as it expands. Certain areas on the Western Seaboard, for example, are now just a 20- to 30-minute bus ride from Cape Town CBD, and in Table View close to the main bus station, the average price of sectional title properties has risen 16% in the past three years, and the average price of freehold homes by almost 14%.

Even better, property all along the Western Seaboard is still much more affordable than on the Atlantic Seaboard or in the Southern Suburbs, and thus much more accessible to the average investor – as is property in central Johannesburg, close to the Park Station Gautrain terminus, where there have been relatively few sectional title sales in the past three years, but the average price has risen by a whopping 69%.

In other words, there are still great opportunities for anyone with an eye on the development of the public transport network to invest in properties with outstanding growth potential.

Getting ready to sell? Don’t forget the garage

Before your home goes on show, you’ll probably spend a lot of time and effort on cleaning, painting, and gardening to make it look “just right” for potential buyers.

And while you’re at it, you shouldn’t forget about you garage, because this is an important amenity for many homebuyers.

If it’s full of boxes, tools, camping equipment, and an assortment of household items – as many garages are – they won’t be able to see where they could park their vehicles, or store their own goods, and while that won’t usually make or break a sale, it could easily detract from the good first impression you’ve worked so hard to create.

You can avoid this by taking the following steps:

- Have a good clear-out. What’s actually in all those boxes? Gather up everything that you don’t use any more – and probably never will – and sell it, donate it or dump it.

- Make the most of the available space by getting things off the floor. Any good hardware shop will offer a variety of hooks to hold bikes and other sporting equipment, garden tools, brooms, and umbrellas. Then add some shelves and possibly some wall cabinets for storing hand and power tools, nuts and bolts, pool chemicals, and paint cans, and already things will look much more orderly and uncluttered.

- Make sure everything is dusted and the floor swept. Use driveway cleaner or thinners to get rid of any oil spots.

- If you have an automatic garage door opener, make sure that it is working properly, and don’t forget the garage door itself. Giving it a fresh coat of paint or varnish if necessary is an easy step that is bound to enhance the overall “curb appeal” of your home.

Recent Posts

Archives

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012