Property market ends the year on a strong note

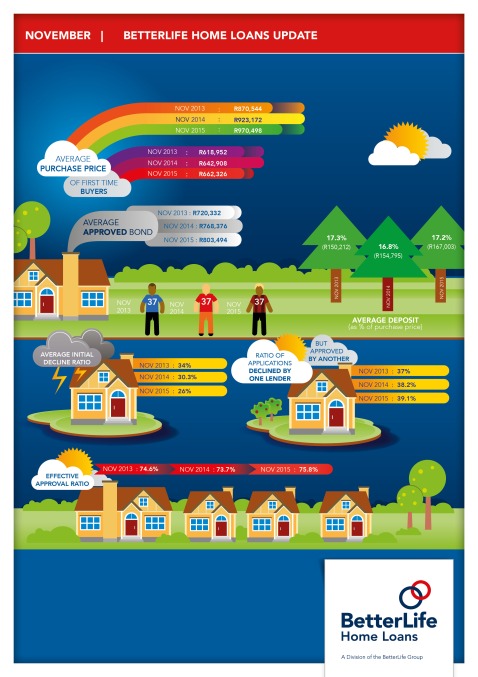

Property values have continued to grow in the past 12 months, with the average home price showing a year-on-year increase of just over 5% to R971 000 at the end of November, according to the latest statistics from BetterLife Home Loans, SA’s biggest mortgage originator. “At the same time,” says CEO Shaun Rademeyer, “the average approved bond size has only increased by 4,6% to R804 000, which means that many buyers are now able to put down bigger deposits in order to secure their home loans. This is especially the case in the higher price categories, where the average deposit now ranges from at least 15% to as much as 40% of the purchase price”, he continues. “Our statistics show, for example, that the average deposit on homes costing R1,5m to R2,5m is R428 000.”

A drastic drop in declined applications – good news for first-time buyers

In addition, Rademeyer notes that the figures reveal that the percentage of home loan applications that are being declined outright by the banks has dropped sharply in the past year from 30% to 25%. “This indicates that prospective buyers generally have their finances in good order at the moment”, he explains.

The BetterLife Home Loans statistics, which represent 25% of all residential mortgage bonds being registered in the Deeds Office, also contain good news for first-time buyers. They show that while the average purchase price paid by first-time buyers rose 3% to R662 000 in the year to end-November, the average approved bond size in that period rose by 4,3% to R617 000. “This saw the average deposit required by first-time buyers shrink by almost 12% to R45 000,” says Rademeyer. “This is a big boost for those who do not have existing homes to sell in order to help raise cash.”

100% loans

“What is more, some 38% of all home loans granted in the past year were for no-deposit or 100% loans – and most of these went to first-time buyers purchasing in the affordable price range up to around R500 000.” This is very encouraging, says Rademeyer, especially in a market that gets most of it’s impetus from demand at the lower end. This allows new owners to then move up the property ladder.

A word to the wise

Rademeyer does, however, call for caution, saying that the banks are by no means insensitive to the fact that rising living costs and the recent increase in interest rates are making it tougher for consumers to keep up with debt repayments. “Credit granting criteria are thus likely to be strictly applied next year and prospective buyers may well find that they have to consider cheaper properties in order to qualify for loans”, he says. “This is likely to put something of a damper on house price growth.”

ISSUED BY

BETTERLIFE HOME LOANS

FOR MORE INFORMATION

CALL SHAUN RADEMEYER ON

011-516-5500 OR VISIT

www.betterlife.co.za/homeloans

Springbok stars in new ads for BetterLife Home Loans

Already a rugby hero and recently selected to be part of the Springbok World Cup team, Trevor Nyakane has added TV personality to his repertoire, as he appears in a series of adverts for BetterLife Home Loans, South Africa’s biggest mortgage originator.

Nicknamed “Pumbaa” by his teammates because of his strength and irrepressible grin, the formidable prop plays a starring role in the ads, which were launched during September. Produced to support a new reality show coming to DStv screens that will air from October.

About the show

BetterLife Home Loans is sponsoring the programme, of which each episode will introduce viewers to a family trying to sell their home somewhere in South Africa, but without much success, as well as to a top local estate agent who is then called in to help.

Viewers follow the story as the agent suggests practical and inexpensive improvements or renovations that will make the home more attractive to buyers. These will then be carried out and completed by the show’s crew, together with the help of certain contractors and suppliers, after which the revamped and ready-to-sell “new” property will be revealed to the owners.

The programme will cover a wide range of properties and recommended improvements that will showcase everything from kitchen and bathroom revamps to decluttering and staging a home for show, paint jobs, clean-ups and landscaping, explains BetterLife Home Loans CEO, Shaun Rademeyer.

The message

“The budget limit is R50 000 per property. The overall message is that it is not necessary to spend a fortune to get your home ready for showing and make it more appealing to prospective buyers – provided you seek the advice of a trained and experienced agent who is familiar with what buyers in your area are looking for”, says Rademeyer. “And this resonates with our message to prospective homebuyers: it is not necessary to struggle through the process of applying for a home loan on your own.”

“It is much easier and more effective to enlist the help of a reputable originator like BetterLife Home Loans that can prepare your application properly, motivate it individually and ensure that you get the best deal possible”, concludes Rademeyer.

Named “Vat Jou Goed en Trek”, the new show will air on the kykNET channel from Friday 2 October at 17h30, with repeats on Saturdays, Sundays, Mondays, Tuesdays and Wednesdays.

Downsizing now not a definite for seniors

Downshifting now does not always equal downsizing among homebuyers of retirement age, according to a new study by Bank of America Merrill Lynch conducted in partnership with Age Wave.

Downshifting now does not always equal downsizing among homebuyers of retirement age, according to a new study by Bank of America Merrill Lynch conducted in partnership with Age Wave.

The aim of this research was to explore the priorities and concerns of retirees and pre-retirees when choosing the homes and communities they hope to live in during retirement, and it found that as people approach the age of 61, they feel increasingly free to choose where they most want to live, without any constraints related to work or family responsibilities.

Also, those who have already retired by this age are more than twice as likely to say they are free to choose where they want to live when compared to pre-retirees (67% compared to 30%).

The study, entitled Home in Retirement: More Freedom, New Choices, also found that 64% of retirees are likely to move at least once during retirement, with 37% of respondents having already moved and 27% anticipating doing so – often to a new part of the country as well as to a new home, with the aim of “downshifting” to a slower paced life in a peaceful environment.

The top motivations for retirees to move include being closer to family (29%), reducing home expenses (26%), and changes in health (17%) or marital status (12%).

However, although the common assumption is that retirees will also always downsize when they move, the study revealed that almost half (49%) of the retirees who had already moved had not downsized at all – and that 30% had in fact moved into larger homes.

Their top reasons for upsizing in this way were to have a home large enough to accommodate family members on extended visits (33%) or one that would comfortably accommodate a multigenerational living arrangement. One out of six (16%) said they had at least one “boomerang” child who had moved back in with them.

Meanwhile among those retirees who did downsize, the main reasons for doing so were greater freedom from the financial (64%) and maintenance (44%) burdens of a larger home.

Commenting on these results, David Tyrie, head of retirement and personal wealth solutions for Bank of America Merrill Lynch, said that with increasing longevity and greater freedom, it was not surprising that so many retirees were striving to make their homes even more fulfilling – but noted that that achieving your dream home in retirement required careful forethought and preparation.”

Indeed, says Shaun Rademeyer, CEO of BetterLife Home Loans, SA’s leading mortgage origination group, whether retirees intend moving or staying put, and downsizing or upsizing, they need to carefully consider the expenses associated with their current goals and future priorities, including potential challenges during later years.

“This is why we always advocate that homeowners do their best to pay off their home loans as soon as possible and free up funds for the future, whatever that may hold for them.”

The surest and easiest way to achieve this goal, he says, is to start paying a more than the minimum monthly bond instalment as soon possible. This will ensure that bond is paid off in far fewer than 20 years and deliver a surprisingly large saving in interest charges over the life of the bond. “What is more, it may enable you to supplement your retirement savings for five or even 10 years by the amount that you would otherwise have been paying off your home loan.”

Prices expected to maintain growth, says Absa

Building costs are not rising as fast as they were a year ago, but it is still more than 30% more expensive to buy a newly-built house than a similar pre-owned house, according to the latest Absa Housing Review.

Building costs are not rising as fast as they were a year ago, but it is still more than 30% more expensive to buy a newly-built house than a similar pre-owned house, according to the latest Absa Housing Review.

Consequently, the strong demand currently evident in the real estate market can be expected to remain focused on pre-owned homes this year, and to exert upward pressure on prices in this sector.

As it is, the Absa report shows, real (after inflation) growth was experienced in every housing category last year and, barring economic disaster, can be expected to continue this year and next, although it is unlikely to exceed single digits.

The Absa figures show that the average price for pre-owned homes in the affordable category (up to 79sqm big and priced at up to R545 000) grew by 1,6% in real terms in the last quarter of 2014, while the average price of small homes (80sqm to 140sqm) grew by 3,5%.

Medium-sized homes (140sqm to 220sqm) recorded a fourth quarter average price increase of 1,3% in real terms, and the average price of large homes (220sqm to 400sqm) grew by 1,6%, but it was luxury homes (priced at 4m to R14,6m) that performed the best, with an average 9,7% real-term increase in price.

Absa says it also expects to see an increase in the rate of growth in outstanding mortgage balances this year, thanks to improvements in economic growth, employment and household income, consumer credit-risk profiles and the risk appetite of the banks.

Interest rates, it says, are not expected to rise beyond 9,5% this year, and real household disposable income is expected to rise as incomes increase and debt levels subside. The nominal wage increase in 2014 was 8,1%, which was ahead of the average inflation rate of 6,1%. According to the Bureau for Economic Research, the consumer financial vulnerability index (CFVI) shifted from 50,4% to 51,4% in the third quarter of last year, which means that consumers are less financially vulnerable now than they were a year ago.

Breaking the performance of the housing market down regionally, the Absa report reveals that house prices in the Free State achieved the highest rate of real growth last year (5,5%), which was no doubt helped by a whopping 11,3% rate of real growth in prices in the Mangaung metro.

Real house price growth reached 5,4% in the Western Cape, mostly due to an real increase of 6,8% in the Cape Town metro; while prices across Gauteng grew 3,5%, boosted by increases of 5,2% in the Tshwane metro and 4,2% in Greater Johannesburg.

The Buffalo and Nelson Mandela Bay metros did not fare as well, however, and this is reflected in a real-term decline of 1% in Eastern Cape home values.

Homeowners are better drivers

We’ve all seen those adverts explaining why women are a better insurance risk than men and deserve lower premiums – and now it seems that homeowners do too.

We’ve all seen those adverts explaining why women are a better insurance risk than men and deserve lower premiums – and now it seems that homeowners do too.

Reviewing an accident analysis done by motor insurance comparison site Insurance.com, a recent Wall Street Journal article says insurers have believed for a long time that drivers who own their homes file fewer auto-insurance claims, on average, than those who rent – and that several companies already take this into account when calculating premiums.

However, says Des Toups, managing editor of Insurance.com, to determine whether homeowners are really less likely to file a claim than tenants, the site decided to analyse data from more than 700 000 drivers who completed an online questionnaire between January 2012 and July 2014.

And what it found, unsurprisingly, was that those most likely to file an accident claim are drivers between 18 and 24 who live with their parents. About 24% of drivers in this group had filed a claim in the past three years, compared to just under 20% of drivers in this age group who were tenants, and just under 18% of drivers in this age group who own their own homes.

The analysis also revealed that this pattern persists well into drivers’ 40s and 50s, albeit at lower levels. For instance, in the 45 to 54 aged group, just over 13% of drivers who own their own homes had filed a claim in the past three years, compared with 14% of drivers who were renting their homes.

Overall, only 14,3% of drivers who are homeowners had lodged an accident claim in the past three years versus 16,8% of drivers who are tenants and 22,2% of drivers who reside with their parents.

Toups says this confirms that there is indeed a strong correlation between homeownership and fewer claims, “and helps to explain why many consumers receive an auto insurance discount simply for owning a home, or additional reductions when they bundle their auto insurance and homeowner’s insurance policies with the same insurance carrier”.

But he does also cautions that just buying a home will not automatically make you a better driver. It is longer-term home ownership, and the responsibility and additional caution that comes with that, which appear to make the most difference to people’s driving habits and thus the likelihood of being involved in an accident.

Another reprieve for consumers

New Reserve Bank Governor Lesetja Kganyago announced today that thanks to lower demand for private sector credit, a sharp drop in oil prices that drove the inflation rate down to 5,9% at the end of October and weak economic growth, the Monetary Policy Committee had decided once again to leave interest rates unchanged.

New Reserve Bank Governor Lesetja Kganyago announced today that thanks to lower demand for private sector credit, a sharp drop in oil prices that drove the inflation rate down to 5,9% at the end of October and weak economic growth, the Monetary Policy Committee had decided once again to leave interest rates unchanged.

He said it had been unanimously decided to keep the repo rate – which is the rate at which the Reserve Bank lends to commercial banks – at 5,75% and prime (as well as the variable home loan interest rate) at 9,25%.

As a result, the repayment on a 20-year home loan of R763 543 – which is the current national average approved bond amount – will remain at R6993 per month, according to SA’s leading mortgage origination group BetterBond Home Loans, while the repayment on the average home loan of R645 007 that is currently being approved for first-time buyers will stay at R5907 per month.

“In addition,” notes BetterBond CEO Shaun Rademeyer, “there will also be no increase for now in car instalments, credit card repayments or other debt commitments, and this will give households a further opportunity to lower their debt burden now if they spend carefully over the year-end holiday period, and put themselves in a much better financial position by next year.”

Meanwhile the stasis in interest rates, he says, will further boost consumer confidence in the residential property market (and not least because it speaks of better economic times to come) but it will probably not make much difference to sales numbers, or prices, until developers re-enter the market strongly and start delivering new stock.

“There is an acute shortage of residential stock for sale in popular areas currently, and lack of new development to take up the slack, which has caused house prices to rise faster than expected in recent months.

“And while there has been no slowdown in demand, these increases have made it more difficult for prospective buyers to qualify for home loans and finalise their purchases, with the result that price resistance is now becoming evident in many parts of the country.”

Nevertheless, Rademeyer notes, BetterBond’s latest statistics show that the percentage of home loan applications being declined outright dropped to 30% in the year to end-October, compared to 34% in the previous 12 months, while the percentage of applications declined by one bank but then “rescued” and approved by a different bank grew from 36,4% to 37,5% in the same period.

“This underlines the fact that the banks are even more willing to lend to homebuyers than they were at this time last year – provided that those buyers are in good shape financially. The unchanged interest rate is thus really good news for those who are trying to pay off their debts and increase the amount of discretionary income they have available to afford a home loan repayment.

“Of course it also helps enormously if their home loan applications are completed correctly and properly motivated, and this is why there is a distinct advantage in applying through a reputable originator like BetterBond, which is prepared to caretake individual applications and, if necessary, submit them to a second and sometimes even a third lender.”

Housing market steams ahead despite rate increases

This year’s interest rate increases have done very little to slow housing demand, and have had no negative effect at all on home prices, according to the latest statistics from BetterBond Home Loans, SA’s leading mortgage origination group.

This year’s interest rate increases have done very little to slow housing demand, and have had no negative effect at all on home prices, according to the latest statistics from BetterBond Home Loans, SA’s leading mortgage origination group.

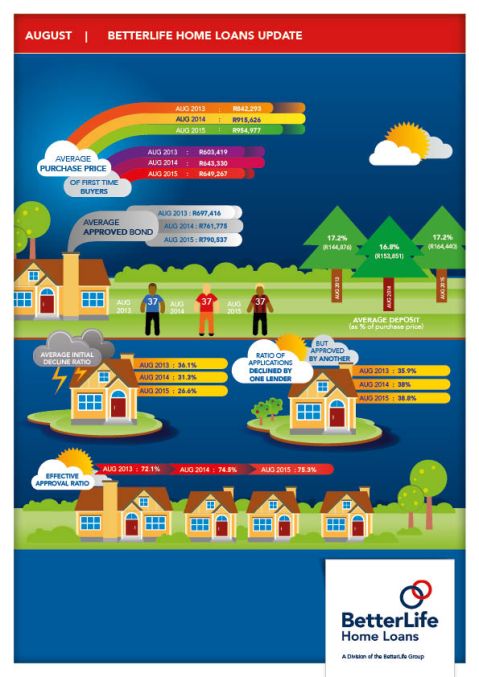

These show, says CEO Shaun Rademeyer, that the average home purchase price increased 6,33% in the 12 months to end-October to R915 678, while the average purchase price for first-time buyers rose 4,76% to R645 007.

“And lending by the banks has kept pace with this growth. For a start, the percentage of purchase price required as a deposit has declined over the past 12 months by 3,53% on average – and by 2,41% in the case of first-time buyers – which makes it easier for buyers to save up the cash they need to complete home purchases.

“At the same time, the average approved bond size in our portfolio has increased by 7,11% to R763 543, and the average for first-time buyers has grown by 5% to reach R591 165.”

What is more, he says, the percentage of home loan applications being declined outright dropped to 30% in the year to end-October, compared to 34% in the previous 12 months, while the percentage of applications declined by one bank but then “rescued” and approved by a different bank grew from 36,4% to 37,5% in the same period.

“This underlines the fact that the banks are more willing to lend to qualified homebuyers than they were at this time last year – provided that applications are completed correctly and properly motivated. And this is why there is a distinct advantage in applying through a reputable originator like BetterBond, which is prepared to caretake individual applications and, if necessary, submit them to a second and sometimes even a third lender.”

As for demand, Rademeyer says, the BetterBond statistics show that the total number of home loan applications submitted to the banks has actually grown by 0,5% in the past 12 months – and that the actual number of approvals has increased by the same margin.

“There has, however, been a decline in the percentage of applications coming from first-time buyers, from 51,6% to 48,1% in the 12 months to end-October, which confirms that repeat homebuyers are currently the main driving force in the market.”