Property market ends the year on a strong note

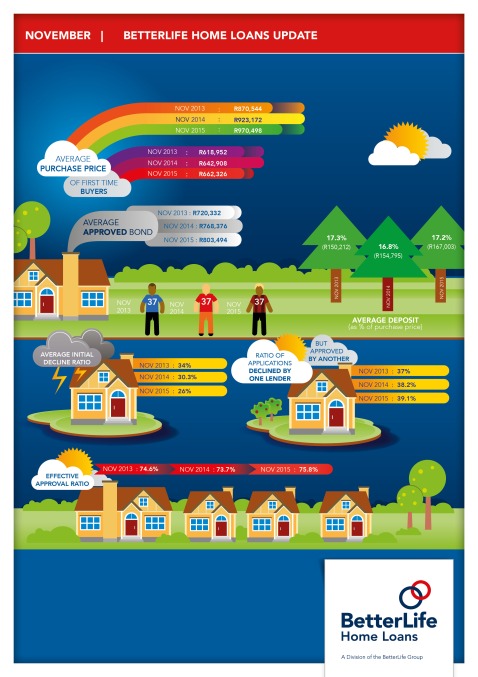

Property values have continued to grow in the past 12 months, with the average home price showing a year-on-year increase of just over 5% to R971 000 at the end of November, according to the latest statistics from BetterLife Home Loans, SA’s biggest mortgage originator. “At the same time,” says CEO Shaun Rademeyer, “the average approved bond size has only increased by 4,6% to R804 000, which means that many buyers are now able to put down bigger deposits in order to secure their home loans. This is especially the case in the higher price categories, where the average deposit now ranges from at least 15% to as much as 40% of the purchase price”, he continues. “Our statistics show, for example, that the average deposit on homes costing R1,5m to R2,5m is R428 000.”

A drastic drop in declined applications – good news for first-time buyers

In addition, Rademeyer notes that the figures reveal that the percentage of home loan applications that are being declined outright by the banks has dropped sharply in the past year from 30% to 25%. “This indicates that prospective buyers generally have their finances in good order at the moment”, he explains.

The BetterLife Home Loans statistics, which represent 25% of all residential mortgage bonds being registered in the Deeds Office, also contain good news for first-time buyers. They show that while the average purchase price paid by first-time buyers rose 3% to R662 000 in the year to end-November, the average approved bond size in that period rose by 4,3% to R617 000. “This saw the average deposit required by first-time buyers shrink by almost 12% to R45 000,” says Rademeyer. “This is a big boost for those who do not have existing homes to sell in order to help raise cash.”

100% loans

“What is more, some 38% of all home loans granted in the past year were for no-deposit or 100% loans – and most of these went to first-time buyers purchasing in the affordable price range up to around R500 000.” This is very encouraging, says Rademeyer, especially in a market that gets most of it’s impetus from demand at the lower end. This allows new owners to then move up the property ladder.

A word to the wise

Rademeyer does, however, call for caution, saying that the banks are by no means insensitive to the fact that rising living costs and the recent increase in interest rates are making it tougher for consumers to keep up with debt repayments. “Credit granting criteria are thus likely to be strictly applied next year and prospective buyers may well find that they have to consider cheaper properties in order to qualify for loans”, he says. “This is likely to put something of a damper on house price growth.”

ISSUED BY

BETTERLIFE HOME LOANS

FOR MORE INFORMATION

CALL SHAUN RADEMEYER ON

011-516-5500 OR VISIT

www.betterlife.co.za/homeloans