What late-blooming homeowners need to know

Although most people have learned a considerable amount by the time they reach their mid- to late-thirties, they may not know much at all about buying a house.

That’s because the age of first-time buyers is now much higher than it was a generation ago, and is still rising in many parts of the world thanks to high levels of student debt among people in their 20s, and a simultaneous trend towards later marriage and family creation.

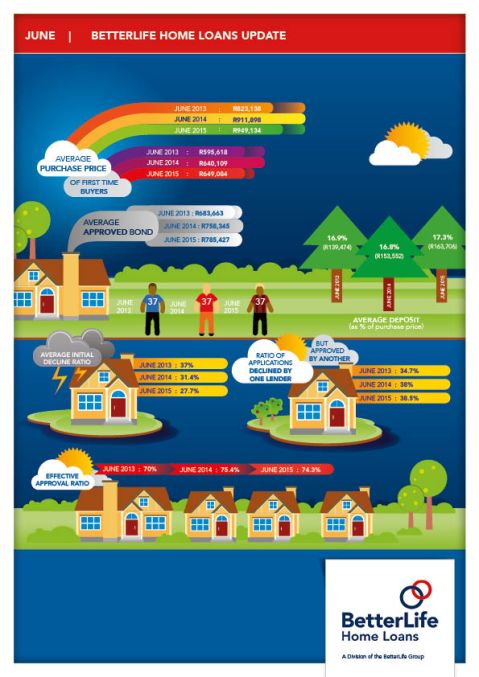

In SA, for example, the latest statistics from BetterLife Home Loans show that the average age of first-time buyers is now 34. And what that means is that they often also have quite different needs – and financial concerns – from those their parents had when they were acquiring their first properties.

Good schools and short commutes, for example, are likely to be much more important, and not only because these often serve to underpin local home values.

Today’s first-time buyers know that an area with great public schools can save you from having to send your children to costly private schools – and what a difference this could make to their family finances in the future.

In addition, thirty-something buyers are more likely to be settled or settling into a career at a particular company and looking carefully at their commute times, especially if there are two income-earners who must travel in different directions to get to work.

And on top of that, such buyers are often not contemplating a second home purchase until after their children have grown up, so they have to be especially careful when making a choice between urban or suburban living. City living would most likely enable them to cut down on commuting and spend more time with their family, but would probably also mean a higher purchase price and less space and freedom for growing children.

On the other hand, while suburbia tends to offer great value these days as well as child-friendly gardens, living there may well mean having to spend much more time and money to get to work.

Next, buyers in their 30s have to manage their finances more closely, taking into account things like saving for their children’s tertiary education and their own retirement. They may have more established careers and earn more than the previous generation of first-time buyers, and they may well qualify for bigger home loans. But just because they can borrow more does not mean they should.

When calculating how much you may borrow, lenders don’t always include such financial necessities as retirement or university savings and future home improvements, and buyers in their thirties must be realistic about the additional financial responsibilities they will face as they age by not taking on a monthly payment that leaves them too little financial leeway.

And finally, the thirty-somethings must try to avoid draining their savings to cover a deposit and transaction costs such as transfer duty, bond registration and legal fees, which usually have to be paid in cash. Doing so leaves buyers vulnerable to major unexpected expenses or events like major surgery for a child, job loss, or sudden disability.

Indeed rather than put their savings at risk, they should find a lower-priced home and/ or one that will require less expenditure on upkeep.

Here’s why cash isn’t always king…

Even if you have enough cash in the bank to be able to buy your next home outright, it might be quite a risky move to do so.

You will need to weigh up the pros and cons listed below, but often homebuyers find that applying for a home loan is a better course to follow – especially if they enlist the help of a professional mortgage originator such as BetterLife Home Loans to simplify and speed up the application process.

PROS

- You will save money by not paying interest on a home loan for 20 years. This may seem like an attractive proposition if home loan interest rates are currently higher than the interest you can earn on savings, especially because the savings you make will be tax free.

- You will avoid having to worry about being approved for a loan – and the bond registration costs.

- Your credit record will also not come into question – which could be a factor if you have had some money trouble in the past that you think might prevent you from being able to secure a loan.

- You will have 100% equity in your home which you should theoretically be able to access if you need money for an emergency – and you may find personal satisfaction in owning your home “outright”.

- You will be an attractive buyer to serious sellers, and the prospect of being able to conclude a faster, simpler deal may even enable you to negotiate a better price.

CONS

- Buying a home for cash will most likely mean that all your money – or at least a large percentage of it – will be tied up in one asset, leaving you little for other investments or savings that could possibly give you a better return.

- If you only want to invest in property, you should seriously consider spreading your risk by using your cash to put down deposits on two or more homes and obtaining a loan for the remainder of the purchase price in each case. There could also be tax benefits in owning one or more rental properties as well as the possibility of better returns on your capital.

- You will have no gearing protection. If all your money is in your home and property prices drop, you will take that percentage drop on the whole amount you paid. For example, if the purchase price was R1m and the market drops by 10%, you will have lost R100 000. But if you only paid a R100 000 deposit in cash and the market drops 10%, your loss will be R10 000. The bank will take the loss on the remainder.

- Property can take weeks or months to sell, which can be a problem if you need money quickly. Even trying to raise a home loan against your property at that stage can take too long if you have a real emergency.

- No bank valuation. When you apply for a home loan, the bank will usually send a valuator to see that there is sufficient value in the property to justify the purchase price. This will not happen if you buy for cash so you will have no “third party” confirmation that you are not overpaying.

Obviously, how you pay for your home is a personal decision, but you should not decide to do away with a mortgage and part with a large amount of cash on the spur of the moment. You should seek professional help to make a proper assessment of your overall financial situation and long-term investment plans.

What to do about the eyesore next door

It is sad but true that no matter how great your home looks on show day, it is not likely to attract any offers to purchase if the home next door or across the road is a run-down wreck with a yard like a panel-beater’s workshop.

In fact, if they spot it first, most prospective buyers will just keep driving – and who can blame them? Old car bodies, eye-high grass and weeds and an overflowing bin of “empties” really don’t create the impression of a safe and friendly neighbourhood where people take care of their homes and property values are likely to keep rising.

The problem is, if that property has been in that state for some time, things are unlikely to change unless you intervene. And that’s probably what you will have to do if you want to get your home sold.

The first thing to try is a friendly chat with the owner of the property – assuming, of course, that you are not already at loggerheads with this neighbour. It’s difficult, of course, to tell someone that their home is an eyesore, but you could try a less direct approach and ask for their help in creating the best possible impression of your area because you need to sell your house – while also pointing out that the higher the price you get for yours, the more their property will be worth. If you are not really on chatting terms, a friendly note along the same lines might do the trick.

Secondly, you should be prepared to help, especially if the owners of the dilapidated property are elderly. If it’s a question of peeling paint, a sagging fence or an overgrown garden, it may just be that they have not been able to manage the upkeep and will be delighted if their nice neighbour (you) offers to help them get their property back in shape. They may even be prepared to pay for materials and rubble removal.

If you live in an estate, a third option is to ask your home owners’ association (HOA) to tackle the owner of the unkempt property. One of the main jobs of an HOA is to ensure the harmonious appearance of the estate in order to protect home values.

Alternatively, if you live in a traditional suburb and your neighbours simply refuse to clean up their mess or to let you help, you can report them to your local authority. Most municipalities have by-laws regarding the health, crime and fire hazards that are posed by derelict properties, and can order the owners to either clear the property themselves or pay to have it cleared by a council crew. You should be prepared, however, for this process to take a few months.

Similarly, if the property is unoccupied because it has been repossessed by a bank, you are entitled to insist that the bank clean it up and maintain it so that it does not pull down local property values – but once again should be prepared for quite a wait.

And finally, it really might be worth putting up a wall and/ or planting a hedge to block your view of the problem property, because even if it does get sorted out in time for your show day, who’s to say the owners will keep it that way? Besides, the additional privacy and security could even become an extra selling point for your home.