Four great ways to lower your housing costs

Housing costs account for at least 25% of most homeowners’ monthly expenditure, so it is definitely worth looking for ways to cut down on them and generate savings – without necessarily having to move. According to the experts, the best time to start this budget exercise is before you even move in by not choosing to buy a home that is more than you actually need. With the strict National Credit Act to consider, it is unlikely that your lender will allow you to buy more home than you can afford, but even that may be more than you really need.

Consider the size of the house you need, not the one you want

What you need to do first is think very carefully about how many bedrooms, bathrooms, and living rooms you and your family will require and use over the next five to seven years. Once that’s decided, you can then set out to find a compact (but not cramped) home that meets your specifications as closely as possible. Having unused rooms is like throwing money away, month after month, in unnecessarily high bond repayments, and having more space than needed will also result in pointless cleaning and energy sacrifice, not to mention lots of unnecessary costs, particularly with regards to maintenance.

Similarly, you should think about the size of the stand or garden you need before you buy. It may be great to have lots of space for children to play or a big poolside patio for entertaining, but a large property usually also means higher bond repayments and more upkeep, as well as higher security costs and higher municipal rate payments.

Save for a down payment

The second way to significantly lower your monthly housing cost is to save up until you can put down a deposit of 10% or even 20%. The larger the deposit, the smaller the home loan you will need, and the lower your monthly bond repayment will be.

In addition, paying a deposit will enable you to save a large amount of interest over the life of your home loan – as indicated in the accompanying table* below – even as you enjoy the benefit of the lower monthly repayments.

| Interest rate % | R800 000 (No deposit) Monthly instalment | Total interest over 20yrs R’s | R640 000 (20% deposit) Monthly instalment |

Total interest over 20yrs R’s |

Interest saving with deposit R’s |

| 9 | 7198 | 927 474 | 5758 | 741 979 | 185 495 |

| 10 | 7720 | 1 052 842 | 6176 | 842 273 | 210 569 |

| 11 | 8258 | 1 181 802 | 6606 | 945 441 | 236 361 |

| 12 | 8809 | 1 314 085 | 7047 | 1 051 268 | 262 817 |

| 13 | 9373 | 1 449 425 | 7498 | 1 159 540 | 289 885 |

| 14 | 9948 | 1 587 560 | 7959 | 1 270 048 | 317 512 |

| 15 | 10 534 | 1 728 236 | 8427 | 1 382 589 | 345 647 |

| 16 | 11 130 | 1 871 211 | 8904 | 1 496 969 | 374 242 |

| 17 | 11 734 | 2 016 257 | 9388 | 1 613 006 | 403 251 |

| 18 | 12 346 | 2 163 158 | 9877 | 1 730 527 | 432 631 |

| 19 | 12 965 | 2 311 715 | 10 372 | 1 849 341 | 462 374 |

| 20 | 13 591 | 2 461 743 | 10 872 | 1 969 395 | 492 348 |

Monitor your utility costs and cut down where you can

The third thing you can do to cut your housing bill is to keep a close eye on your utility costs. As electricity and water charges continue to rise, even normal household activities like heating bathwater, cooking, keeping your home warm enough or cool enough, watering the garden and doing your washing can result in a hefty monthly bill from the municipality, so it is really worth trying to lower your consumption wherever possible.

Fortunately, there are many quick and easy ways to do so that don’t require a major capital outlay. Timer switches and geyser blankets are relatively inexpensive tools to help cut the cost of heating water, for example, while some basic insulation and weatherproofing can go a long way towards reducing the need for heating in winter and cooling in summer. Many homeowners also save money by increasing use of a microwave instead of a stove, or by installing ceiling fans instead of air-conditioners. Some even opt to make use of harvested rainwater for the garden and laundry. What is more, as these savings add up, you can choose to pay an additional amount off your mortgage every month, shorten the overall loan period and in so doing, generate even bigger interest savings through the power of amortisation.

Stay on top of home maintenance

The fourth and final way to lower housing costs is to get organised when it comes to home maintenance and upkeep by drawing up a workable schedule or annual plan. Everyone knows the saying that a “stich in time saves nine” and it is certainly true of home maintenance, especially when a small task done in time can save you from having to pay for a large and costly repair job down the line. The added bonus here is that by staying on top of things and keeping your home in good condition, you help protect its resale value – something that will benefit you hugely if and when you decide to sell one day in the future.

A little can go a long way and by doing what you can to cut down on your housing costs, you can actually end up saving a significant amount of money that can be better used elsewhere.

*Table is for indicative purposes only

Things to consider before buying a newly-built home

An increasing number of South African homebuyers are electing to buy newly-built properties rather than pre-owned homes, and there are in fact a number of very good reasons for doing so.

No transfer duty

For most buyers, the most important of these is the cash they save because there is no transfer duty payable on homes bought directly from a developer or builder. Instead, VAT is assumed to be included in the purchase price (provided that the developer is registered as a VAT vendor).

Lender pre-approval

Another big plus is that new developments by established building or development companies are often “pre-approved” by a lender, making it much easier for prospective buyers in these projects to obtain home loans.

High chance of customisation opportunity

In addition, residential developers often give buyers the opportunity to choose their own fittings and finishes, and sometimes even the chance to customise the layout of their new home and garden to suit their own needs. On top of that, new homes in South Africa come with certain structural guarantees and must comply with certain “green” design and building principles, making them more eco-friendly and energy-efficient. This all translates into less maintenance and long-term savings for their owners.

The other side of the coin

However, there are also quite a few potential pitfalls that those who are considering a newly-built home need to try and avoid if they want their home-buying experience to be as exciting and fulfilling as it should be. These include:

Deposit scams when buying “off-plan”

Anyone can print a fancy brochure full of floorplans and attractive pictures so you should never sign an offer to purchase a home that has yet to be built unless you have:

- Seen the land on which it is due to be constructed

- Established that the developer has a good reputation, is registered with the National Home Builders Registration Council

- Seen that the property developer has a track record of successfully completed projects.

In addition, you must make sure that any deposit you are asked to pay is going into the trust account of an attorney or any estate agent so you will not lose your money if something goes wrong with the development or the building company.

Long-term developments

It can be exciting and financially rewarding to be one of the first owners in a new development, but you need to know that the project will be finished and fully-developed within a reasonable period. If there are 50 stands, for example, and only 20 homes have been built in the development in the past five years, that may be cause for concern. In this case, you should probably give it a second thought, unless the developer can prove to you that the other 30 stands have now been sold and that they will be completed within the next few months. If this isn’t on the cards, then you could find yourself living on a “building site” for several years and therefore unable to sell because the levy income from only a handful of owners would be insufficient to provide the type of security and the additional facilities that were originally promised – things that would make your home appealing to potential buyers.

Too many “extras” and upgrades

Check your plans and building contract very carefully before you sign for a newly-built home in order to determine exactly what building materials, equipment, fittings and finishes are included in the specifications (and what else may be regarded as “extra” for which you would have to pay an additional amount). Do not make the mistake of assuming that all the top-of-the-line finishes that you see in the developer’s show-home will automatically be included in your home, or take it for granted that the rooms in your home will be the same size. A whole lot of the features you like most may not actually be included in the basic contract and including them could put the home beyond your budget. In addition, if you do decide to opt for upgrades, you should not just accept a whole package. Consider each item to see if you really need it or could live without it, and make certain that everything you choose is individually specified in your building contract along with its price.

No completion or hand-over date

Your contract must contain a date by which your new home will be finished and ready for occupation. If it is not finished by the date stipulated, you will then be entitled to cancel the contract and get back all the money you have paid so far, including the deposit and any progress payments made to a builder. If your contract does not contain this clause, you could find yourself at the mercy of a builder who is taking far too long to finish the project while you are stuck making bond repayments on a home you cannot occupy.

No provision to rectify problems

Even newly-built homes can have faults, and whether it is a cracked tile or a major water leak, you should not have to live with it or pay to get it fixed before you’ve even unpacked. To prevent this from happening, you must make sure that your building contract states that you will have a certain number of days after taking occupation to draw up a “snag” list of defects for the developer or builder to fix before you finally sign the occupation certificate. You should also retain the right to call in an independent and professional home inspector to help you at this point, especially if this is your first home purchase.

Purchasing your own home is one of the most important investments you will ever make, so it’s in your interest to ensure that you’ve considered everything you need to before buying, especially if it’s a newly built home in which you’re interested.

Home loan approvals beat the winter chill

The number of home loans being approved by banks is currently growing at a faster rate than at the beginning of the year, despite the fact that the winter months are usually the slow season for home sales and bond applications.

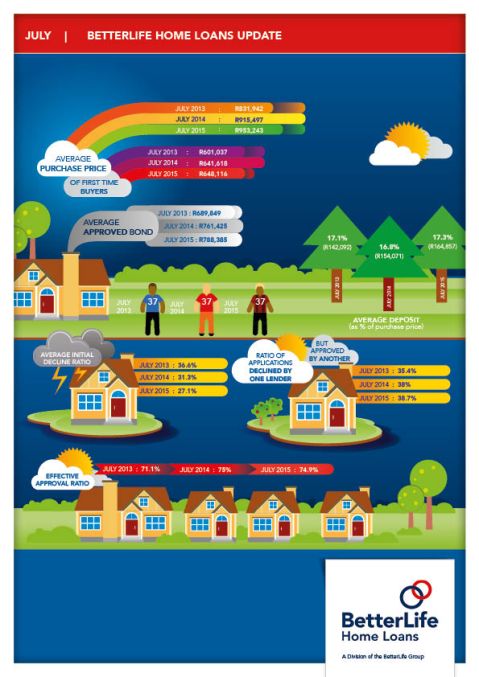

“This may change in the wake of the interest rate increase that took place at the end of July,” says Shaun Rademeyer, CEO of South Africa’s biggest mortgage originator, BetterLife Home Loans. “Our statistics show that the year-on-year increase in the number of loans being approved has risen from a steady 1% in the first few months of 2015 to 2% in the past two months.” The faster rate of growth, he says, follows continued increases in the number of home loan applications being submitted by prospective homebuyers, and continued decreases in the number of applications being declined by the banks.

What the stats are saying

The BetterLife Home Loans statistics, which represent 25% of all residential mortgage bonds being registered in the Deeds Office, show a year-on-year increase of 3,2% at the end of July in the number of home loan applications being submitted. The number of applications being declined by the banks fell by 11,7%, following a 15,6% drop in the previous 12 months.

“The picture this paints is of a market that is in healthy equilibrium at the moment. While maintaining strict credit qualification criteria, the banks are keen to lend now and expand their home loan books, meaning a bigger percentage of prospective homeowners are able to qualify for loans”, explains Rademeyer. “However, it must also be said that prospective buyers still have a far greater chance of their loan being approved if they apply through a reputable mortgage originator like BetterLife Home Loans. We have a success rate of 75%, compared to the overall average current approval rate of 60%.” He also says that although the July rate increase and another small rate increase expected later in the year will probably dampen home price growth, they are not expected to significantly slow demand.

“As it is, both lenders and buyers have demonstrated continued confidence in real estate over the past two financially trying years for the economy. That is reflected in the fact that the average home price has risen by over 14% during this period to R953 000, and the average approved bond amount by the same percentage to R788 000.” Over the same period, he notes about 47% of home loan applicants were first-time buyers, and the average home price paid in this sector of the market rose by almost 8% to R648 000, while the average approved bond amount increased by 9% to R601 000.

Further analysis of the latest statistics also reveals that the upper end of the market continues to hold its own, with 28% of all home loans formally granted by the banks in the 12 months to end-July having been for more than R1 million, compared to 27% in the previous 12 months.

Visit http://www.betterlife.co.za/ for more information.

How to choose the best offer for your home

In any town or suburb where the demand from prospective buyers exceeds the number of homes for sale, it is usually only a matter of time before property sellers start to receive competing offers to purchase – and then have to decide which of them to accept or reject. While this may seem like a good problem to have, the decision might not always be as easy to make as you think, mainly because all too often, selling a home is about more than just the money.

The conundrum

What if you receive an offer that is considerably more than your original asking price but on condition that you move out sooner than you were hoping and give the buyer occupation by the end of the month? The reality is that you may not be willing – or able – to accept it. But if it’s an offer you simply can’t refuse, then you will find yourself making the necessary arrangements in order for this to happen. On the other end of the spectrum, you may choose to accept a lower offer from a prospective buyer who has already been pre-approved for bond finance, simply because it will eliminate having to wait for another person to organise finance or sell their current home.

Consider all the factors

Indeed, there are many factors to consider and, as any good estate agent will agree, you really need to look beyond price before you decide – and to resist being pressurised into making a hasty choice that would ultimately be wrong for you. For example: a buyer that makes a good offer but says it is only on the table for a couple of hours, is probably not that serious and if they are, they’re likely to prove difficult to deal with during the transfer process – and who wants that?

So what steps should I take when making a decision?

So, if you do end up in the middle of a “bidding war” for your home, you should start by looking for the offers with the fewest contingencies or “get out” clauses. Ideally, your would-be buyer should not have another property to sell before they will actually be able to buy yours, and should have home loan pre-approval so you can be confident that they really will be able to secure the necessary home loan within a few days.

Next, you may want to consider which prospective buyers are most willing to accommodate your timing with regards to occupation of the property. If you need to delay a move until the end of a school term, for example, or until the end of a work contract, that can have a significant influence on which offer you will accept.

In addition, you should try and find out whether the competing buyers already have the cash in hand needed to pay a deposit, as well as the transfer duty, bond registration costs and legal fees. It is no good accepting a higher offer if you are going to have to wait months for that buyer to get the cash together. At the end of the day, your agent should in fact only be bringing you offers from people who are financially able to buy your property, as well as willing to do so.

The power of negotiation

You also need to make sure that you negotiate transparently and in good faith. For example, if you tell someone who made an offer on a Saturday morning that you’re not going to respond until Monday, you must also tell them that this is because you are expecting further offers after your show house on Sunday. If you then receive several similar offers, you should be open about those as well, and give each of those prospective buyers the opportunity to confirm that this is their “best and highest” offer, or to find out what it would take to make you pick their offer and decide if that’s something they’re willing to do. You must then, however, be prepared to accept the improved offer. Tempting as it may be to keep a “bidding war” going, most buyers won’t like it, and as a result, you then run a very high risk of ending up with no solid offer at all.

There are many factors that need to be taken into consideration when choosing the best offer for your home. It’s a decision that can take quite some time and thought, but because it’s an important one, it’s better to consider everything you need to before drawing that final conclusion.

Buying a home after getting divorced

Getting divorced is tough, and buying a new home afterwards may be just as hard, especially if you are still the co-owner of a property with your former spouse.

This is according to Shaun Rademeyer, CEO of BetterLife Home Loans, SA’s biggest mortgage originator, who says if you were previously part of a two-income household, and qualified for your last bond on that basis, it may be very difficult to qualify for a new home loan on your own, particularly if you are the one making child support payments.

“You will obviously not have the same discretionary income as before, so the banks will probably err on the side of caution when assessing whether you will also be able to manage a monthly bond repayment on your own place.”

As a result, he says you may need time to pay off some debt, raise your credit score and hopefully receive a salary increase.

He says in divorce cases it is also quite common for the husband to move out of the joint home and agree to his ex-wife and children continuing to live there for a few years while he pays the home loan instalments, especially if she has not been working full-time and does not have the means or the credit record to rent or buy a home on her own.

But in such instances he is essentially ‘lending’ his creditworthiness to his ex-wife, and may be foregoing his chance to buy another property for a long time, says Rademeyer.

“And at the very least in such cases, he should ensure that there is a proper agreement in place about how the proceeds will be divided when the house is eventually sold.”

Similarly, he says if you are the “spouse left in the house”, you may want to think twice about trying to buy your ex out and take on the whole mortgage. Even if you are working and can qualify to do so, it will most likely put you under financial strain, as you will also then have to carry all the insurance and maintenance costs on your own, he says.

“In short, you may be better off buying a new, less expensive property in your own name.”

However, all the experts agree that it is a bad idea to try to buy a new home while you are still going through a divorce, he says. For one thing, the stress and emotion of the situation could well lead to you making bad purchase decisions, and for another, lenders will most likely not want to approve any home loan application until the divorce settlement has been agreed.

“And if the joint property is to be sold as part of that settlement, both parties would really be better off renting until that sale has been finalised, if at all possible.”

One reason is that if you are meticulous about paying your rent on time, this will assist you to build up a new credit record as a single person and then, perhaps, to use your half of the sale proceeds as the deposit on a new place, he says.

“At that stage, however, your best course would be to consult a reputable bond originator and obtain pre-approval for a home loan before you go house hunting.”

He says this will give you confidence that you are looking at homes you can afford, and give a seller the confidence to accept your offer to purchase in the knowledge that you will be able to obtain the necessary finance to complete the transaction.

Credits Property24: http://www.property24.com/articles/buying-a-home-after-getting-divorced/22128