Don’t let tenants tangle your sale

With the demand for property still strong at the moment, a growing number of property owners believe the time is right to sell homes they have been renting out – but they should be aware that this can be difficult if they still have a tenant in place.

“Unfair as it may be, tenants generally have a reputation for not keeping homes in the best condition, and many potential buyers seeking a home for themselves will be reluctant to look at a property with a sitting tenant,” says Shaun Rademeyer, CEO of BetterBond, South Africa’s leading mortgage originator. “In many cases, even buy-to-let investors who might be interested in adding the property to their portfolio would prefer to find their own tenants.

“And incumbent tenants who do not want to move can create major problems for a seller. To start with, they may be difficult about giving an agent access to the property to show it to prospective buyers, or perhaps deliberately leave the home in a mess when they know the agent is coming round with potential buyers.”

He says tenants have also been known to try to block a sale by regaling potential buyers with every real or imagined fault in the property or the neighbourhood.

“In addition, property owners who have not made regular inspections may be in for a nasty shock when they decide it is time to sell because maintenance has been neglected, and expensive repairs are necessary before the property can be put on the market. And if pets or animals have been kept inside, the home will at the very least need thorough cleaning, and perhaps re-carpeting.”

There may, of course, be no problem where tenants have been carefully selected from the outset, says Rademeyer, and often if the property is to be sold, the best course is to first find out whether these sitting tenants might like to buy it themselves.

“But if that is not possible, it is generally better to give them reasonable notice and then prepare the empty property for sale, with the incentive for prospective buyers that it is ready for immediate occupation.”

BetterBond reports an ongoing positive trend for residential property

The average home purchase price showed a year-on-year increase of 11,6% at end-February, and now stands at R882 000, according to the latest statistics from BetterBond – which accounts for more than 25% of all residential mortgage bonds being registered in the Deeds Office and is South Africa’s leading mortgage origination group.

These figures also show substantial year-on-year increases in both the number and value of home loan approvals, with BetterBond achieving a massive 12,6% increase in its home loan approval ratio to 76,6%.

“We secured more than 52 000 home loan approvals with a total value of R38,3 billion in the 12 months to end-February, compared to 49 000 approvals valued at R34,5 billion in the previous 12 months,” says group CEO Shaun Rademeyer.

“This shows continued healthy growth in the residential property market, with prices rising in response to higher demand from prospective buyers as well as the higher rate of bond approvals, which enable more of those purchasers to actually buy the homes they want.”

This positive trend is underlined, he says, by the fact that the initial decline ratio for home loan applications made through BetterBond has dropped by almost 19% in the past 12 months, while both the number and value of “rescued” applications (those declined by one bank but approved by another) have risen substantially.

“Indeed, of the R38,2 billion worth of applications approved in the past 12 months, some R18 billion worth were applications that were ‘rescued’ because we were able to submit and motivate them to multiple lenders.”

The average bond amount approved showed a year-on-year increase of 4% at the end of February to R740 000, with the average percentage of purchase price required as a deposit staying virtually static at just under 19%, says Rademeyer.

And there is still strong activity in the first-time buyers’ sector, he notes, although the percentage of applications being made by such buyers has declined, year-on-year, from 53% of the total to 48% – “probably in response to a drop in the number of 100% (full purchase price) home loans being granted and the simultaneous substantial increase (7,7%) in the percentage of buyers being asked to pay a deposit of at least 10% of the purchase price”.

The average deposit required of first-time buyers over the past 12 months has in fact been 10,6% of the purchase price, while the average home purchase price in this sector of the market has risen 8,4% to R628 000, thanks mostly to the fact that new development is still lagging demand.

Home affordability now under pressure

Homebuyers are heading for an affordability squeeze this year and should hasten to buy if they don’t want to get caught between rising interest rate and increasing home prices on the one hand, and low wages and salary increases on the other.

Homebuyers are heading for an affordability squeeze this year and should hasten to buy if they don’t want to get caught between rising interest rate and increasing home prices on the one hand, and low wages and salary increases on the other.

That’s the word from Shaun Rademeyer, CEO of BetterBond, SA’s leading mortgage originator, who adds that buyers should also be allowing themselves some financial leeway now in anticipation of a further 100 to 200 basis point rise in interest rates this year.

“Our latest statistics show that the average home price has risen from R914 000 to R936 000 in the past 12 months, while the average approved bond size has risen from R729 000 to R780 000.

“Meanwhile the 50 basis point rate increase announced in January has already increased the monthly repayment on an average home loan approved at the prime rate by R249 – and the monthly earnings required to qualify for that loan by R850.”

And if rates rise by just another 100 basis points this year, he notes, the monthly repayment on an average loan will go up by a further R509, while the salary required to qualify will need to increase by 11%.

“This is without any further increase in house prices, which seems unlikely, and is alarming in the light of the fact that the latest salary trends survey by leading human resources company ECA International shows that most employees in SA can anticipate a wage or salary increase of just 7% this year – or 1% after inflation.”

So the message is clear, Rademeyer says. “Those who have been sitting on the fence waiting for the ‘best’ time to buy should make a move to do so as soon as possible or they could quickly find themselves priced out of the market.

“However, they should also be very careful to allow for a 1 or 2 percentage point rate increase when they are deciding what to buy – which in most cases will mean buying a smaller, less expensive property, or paying a substantially higher deposit.

“Just how much cheaper the property should be, though, or how much bigger the deposit, is something prospective buyers should work out with a reputable mortgage originator like BetterBond before they go house hunting, because there is a real danger of overbuying with the market in its current state of flux.”

Property leaders positive on Budget

Finance Minister Pravin Gordhan’s Budget speech received a positive reaction from the heads of various real estate companies.

Dr Andrew Golding, CE of the Pam Golding Property group welcomed the minister’s efforts to prioritise economic growth, job creation and infrastructure expenditure. Golding also praised the provision of R9.3-million in tax relief for cash-strapped consumers.

“From a property market perspective, it is disappointing to note that there was no property specific tax relief or schemes introduced which would help home ownership generally, but in particular first time home ownership. However, new spatial plans for cities, upgrading informal settlements, increased social infrastructure and improved public transport, coupled with the announcement of 216 000 houses to be built, is positive news,” says Dr Golding.

“Of concern however, particularly on the back of recent fuel price hikes, is the increase in the general fuel levy by 12 cents a litre and the road accident fund levy by 8 cents a litre, as this places further pressure on consumers and inflation.”

“All in all, the Budget appeared to meet the challenging need for a balance between curbing unnecessary expenditure and investing in our country and its people. Considering the ongoing global economic uncertainties faced, South Africa’s economic policy has consistently achieved a stable economy and the Minister of Finance is commended on this,” concludes Dr Golding.

Shaun Rademeyer, CEO of BetterBond, was pleased with the announcement of measures to help small businesses in South Africa but also lamented the lack of tax relief for homeowners.

“We were also pleased that further measures were announced to encourage small business development, as this indicates growing government recognition of this sector’s ability to generate employment and assist more South Africans to rent or buy decent housing,” Rademeyer said.

Berry Everitt, MD of the Chas Everitt International, said that the Budget met expectations for an election year.

“The focus on education, health, housing and infrastructure, grants and pensions was thus almost inevitable, and it is also no surprise that the widely rumoured tax increase for the wealthy did not materialise.”

Lew Geffen, chairman of Sotheby’s International Realty in SA, also welcomed the decision not to raise the tax rate on the wealthy.

Geffen says this type of wealth tax, similar to that recently imposed in the UK and some European countries, is of course an easy answer for governments that urgently need to raise revenues to please poor voters who are clamouring for service delivery.

“However, the Minister has realised that it is also a trap, because it generally offers only a very short-term advantage, followed by a long and often permanent drop in revenues. High earners are quick these days to react to any punitive tax measures by simply moving their wealth elsewhere and, once bitten, are reluctant to move it back again, especially if, as in SA, they perceive their contribution are being wasted through widespread corruption.”

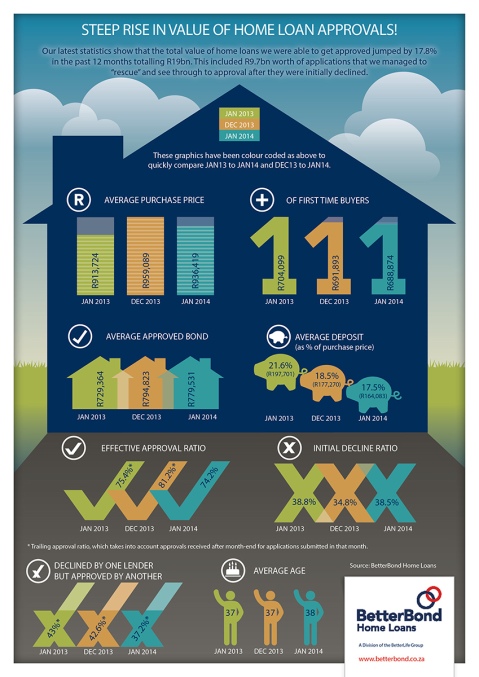

Rise in value of home loan aprovals infographic

Last week’s article explained that the total value of home loan applications submitted by BetterBond Home Loans, SA’s biggest mortgage origination group, had increased by more than R2 billion (or 9,5%) in the 12 months to end-January, to a total of R23,6 billion. This week we summarise the information in an infographic for a quick glance and easy sharing.

Steep rise in value of home loan approvals

The latest statistics released by BetterBond Home Loans, SA’s biggest mortgage origination group, show just how much the residential property market has strengthened over the past year.

The total value of home loan applications submitted by the group, for example, increased by more than R2 billion (or 9,5%) in the 12 months to end-January, to a total of R23,6 billion.

The total value of bonds for which the group was able to obtain approval during the period rose even more steeply (by 17,8%) to R19 billion – which included R9,7 billion worth of applications that it was able to ‘rescue’ and see through to approval after they were initially declined.

The average approved bond size in the 12 months to end-January was R781 087, compared to R715 240 in the previous 12 months.

The increase in the value of bonds approved, says BetterBond CEO Shaun Rademeyer, was partly due to a year-on-year increase in the average home purchase price from R876 248 to R952 579, but also to an increase in the actual number of applications.

“In addition, a better quality of applications from potential borrowers and an increased appetite for long-term lending on the part of the banks resulted in a 13,5% drop in the average number of applications that received an initial decline from the banks – and helped to bring about an 8,7% increase in our average monthly bond approval ratio.”

The quality of the applications was better, he says, because potential borrowers were generally in much better financial shape in 2013 than in 2012, having worked hard to reduce their debts and increase the amount of disposable income they had available to cover their monthly bond repayments.

“There also appeared to be much wider acceptance of the need to pay a deposit – and of the advisability of doing so, not only in order to increase the chances of qualifying for a home loan, but also so as to create some repayment leeway should interest rates start to rise as they have recently just done.”

Simultaneously, Rademeyer says, the average percentage of purchase price required by the lenders as a deposit fell from 20,45% in the year to end-Jan 2012 to 18,98% in the 12 months to end-Jan 2014, so the actual average deposit required actually rose very little, despite the increase in house prices.

With regard to first-time buyers, he says there was a slight increase in the bank’s willingness to grant bonds for 100% of the purchase price of a property, and that home-buying in this sector has also been facilitated by somewhat slower growth in home prices at the lower end of the market.

“In addition, the average percentage of the purchase price required as a deposit by first-time buyers also showed a substantial year-on-year decline from 12,4% to 10,6%, which actually equated to a R6000 drop in real terms.”

BetterBond’s statistics show that the average approved bond size for first-time buyers in the past 12 months was R622 384, compared to R579 933 in the previous 12 months.

Australian originator sheds light on commissions

Michael Russel, CEO of Mortgage Choice, Australia’s biggest independently-owned originator, recently took it upon himself to correct some misconceptions about the commissions that originators receive from banks in return for the home loan business they generate.

He was responding to media articles, which claimed that originators were failing to adequately disclose these commissions to customers, and that borrowers were being charged additional interest on their home loans to compensate the banks for the commissions they had to pay to originators.

“It is important to set the record straight, and to reassure home buyers that licensed mortgage brokers (originators) are actually working in their best interests,” he said.

Firstly, he noted, there was legislation in place, in the form of the National Consumer Credit Protection Act, to protect consumers from non-disclosure of any fees or commissions paid with regard to their home loans.

Secondly, he said, there was categorically no premium added by lenders to their published mortgage interest rates to compensate for paying mortgage broker commissions. “It is widely publicised that lenders pay mortgage brokers a commission for arranging a loan… and customers are not penalised in any way for using a mortgage broker as opposed to going direct to that same lender.”

And the situation is almost exactly the same in South Africa, notes BetterBond Home Loans CEO Shaun Rademeyer. “Here consumers have the National Credit Act and the Consumer Protection Act to provide safeguards against non-disclosure, and only accredited originators can apply for bonds on behalf of consumers.

“What is more, there is absolutely no additional charge to the consumer who secures a home loan through an originator rather than going directly to a bank. In fact, thanks to the efficiency of our loan application procedures, borrowers who are customers of originators will often end up paying a lower rate of interest on their bond, thereby saving many thousands of rands in interest over the life of the loan.”

Shifting the focus on singles

The popularisation of the solo life is a historic change in society, according to sociologist Eric Klinenberg, author of ‘Going Solo: The Extraordinary Rise and Surprising Appeal of Living Alone’.

In a recent essay for The Guardian, he noted that the percentage of solo households was growing in many industrialised countries, with Sweden having the highest rate of solo living at 47% of households, Norway 40%, the UK 34% and Japan 30%.

The trend is also growing in the US, where the latest census figures show that single adults now account for about 25% of households, and that two thirds of those householders are single women.

One reason for this, says Klinenberg, is that the generally greater personal wealth in developed countries enables singles to sustain relatively expensive one-person homes. In addition, people are marrying later, divorcing more frequently, and living longer.

But whatever their reason for living solo, the adults who do so have become an increasingly important demographic for estate agents, most of whom were used to dealing with couples and families when marketing properties.

Indeed, South African agents have already found solo buyers an increasingly important target market for properties such as inner-city flats, and sectional title townhouses in security complexes and on estates.

However, the pace of growth in new household establishment tends to slow down when economic growth and employment creation are sluggish, as they are currently in SA. In these circumstances young people tend to delay leaving their parents’ homes to establish their own households, and elderly singles are more likely to also live with family, often in the three- or four-generation households we now see coming to the fore.

Other singles, with or without dependents, often prefer to continue to rent until the employment market is less uncertain and they can be sure they will be able to afford the monthly bond repayments on a home of their own.

Consequently, agents may now need to refocus their marketing for smaller properties towards the many existing homebuyers who are looking to downscale. Increased property rates, the rising cost of utilities, the lack of time for maintenance and upkeep of a large property, and concerns over security are making this an increasingly popular move among couples and families of all ages.

In addition, many of the buyers that are coming into the market now are concerned about the environment, and want smaller, energy-efficient homes that will reduce their carbon footprint.

Home buyers need higher incomes, says BetterBond

According to the latest statistics from BetterBond Home Loans, South Africas’s biggest mortgage origination group, home buyers in South Africa now need to earn a gross monthly income of around R30 000 to buy an average home costing R952 000.

The BetterBond figures also show that 64% of buyers currently have to pay a deposit in order to secure a home loan, and that the average deposit required for a home priced at R952 000 is around R99 000 – or 10,4%.

“This puts the average home loan required to buy such a home at R853 000, and the average monthly bond repayment at just over R7 400,” says BetterBond CEO Shaun Rademeyer. “In the days before the National Credit Act, when the simple rule-of-thumb was that your monthly bond repayment should not exceed 30% of your gross salary, that would have meant that a gross salary of R24 700 was enough.

“But in terms of the Act, banks are obliged to try to stop consumers from becoming over-indebted. So when they consider a home loan application, they must now also take into account your existing debt commitments and regular monthly expenses, and see if there is enough disposable income left over to comfortably cover the monthly bond repayment.

“Because of the high household debt levels in the country, and the continually rising cost of food, transport, utilities, healthcare, and education, most prospective homebuyers now need to have higher earnings in order to ensure that there will be a big enough amount ‘free and clear’ every month to cover their bond instalment.”

Things are a little easier for first-time buyers, says Rademeyer, with the average home price in this sector of the market having risen by just R27 000 in the past 12 months, and deposit requirements having shrunk considerably to between about 6% and 10%.

“What is more, about two-thirds of the 100% bonds that are being granted are going to buyers at the affordable end of the market where most buyers tend to be first-timers.”

In any case, he notes, the banks’ still-strict lending criteria do not appear to have put much of a damper on the demand for home finance – or in fact on the banks’ willingness to lend to qualifying applicants.

The BetterBond statistics show a 3,75% year-on-year increase in November in the number of home loan applications received and, even more significant, a 14% increase year-on-year in the number of applications formally granted (that is, approved and taken up by the borrowers).

The figures also reveal a 10,5% year-on-year drop in November in BetterBond’s initial decline rate (the percentage of applications declined by the first lending institution to which they are submitted) and a 15% year-on-year increase in the ratio of applications declined by one bank but approved by at least one other.

This took the group’s average approval ratio to 76% in November, which means that it is securing a bond approval for at least three out of every four of its applicants – and the statistics reveal that about 80% of these approvals are taken up by borrowers and converted to formal grants.

How to protect your pre-approval

Once you have been pre-approved for a home loan, you should avoid making any significant changes to your financial situation until you have bought your new home and your home loan account has been activated.

It would seem obvious, for example, that you need to keep paying your bills in the time between home loan pre-approval and the transfer of your new home, but it is easy to forget things or pay late in the excitement of house hunting.

In addition, you should make sure you don’t go into overdraft on any of your accounts, and that any debit order payments are left as they are. Your preapproval is a “snapshot” of your financial situation at a particular time, and you need to stay as close to that picture as possible until your home loan is granted.

This is why you should also not apply for any new credit during this period. Mortgage lenders are bound to do a second credit check before a final loan approval, and if you’ve opened a new account, this will have to be verified, and that could delay your approval. Of course your credit score could change because of the new credit, which might mean an adjustment to the interest rate you will be charged as well.

What is more, if you have bought something major on credit, the lender will have to factor the repayments into your debt-to-income ratio, as required by the National Credit Act, which could result in you not getting the loan at all.

You should also be careful about paying cash for large purchases at this time, or even paying off a debt like a credit card balance, as that could result in you having lower reserves to cover a deposit or the transfer costs, and once again change the lender’s assessment of your financial situation when it comes to granting the loan.

In short, every move you make with your money will have some sort of impact, so you should consult your mortgage originator and the lender that gave you the pre-approval before you do anything.

If you can avoid it, you must also really try not to change jobs after a preapproval. Even if it seems like a good career move, the bank would have to verify the details and might well require a few months’ worth of payslips to prove your new salary, and that could delay your loan approval by quite a long time.

And finally, although adding to your assets should not be a problem, you should keep records of any unusual deposits into your bank accounts at this time. If you receive a bonus or a gift of cash, for example, or sell some shares or other assets, you must be able to prove where the money came from.

Recent Posts

Archives

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012